Davyhurst Project Overview

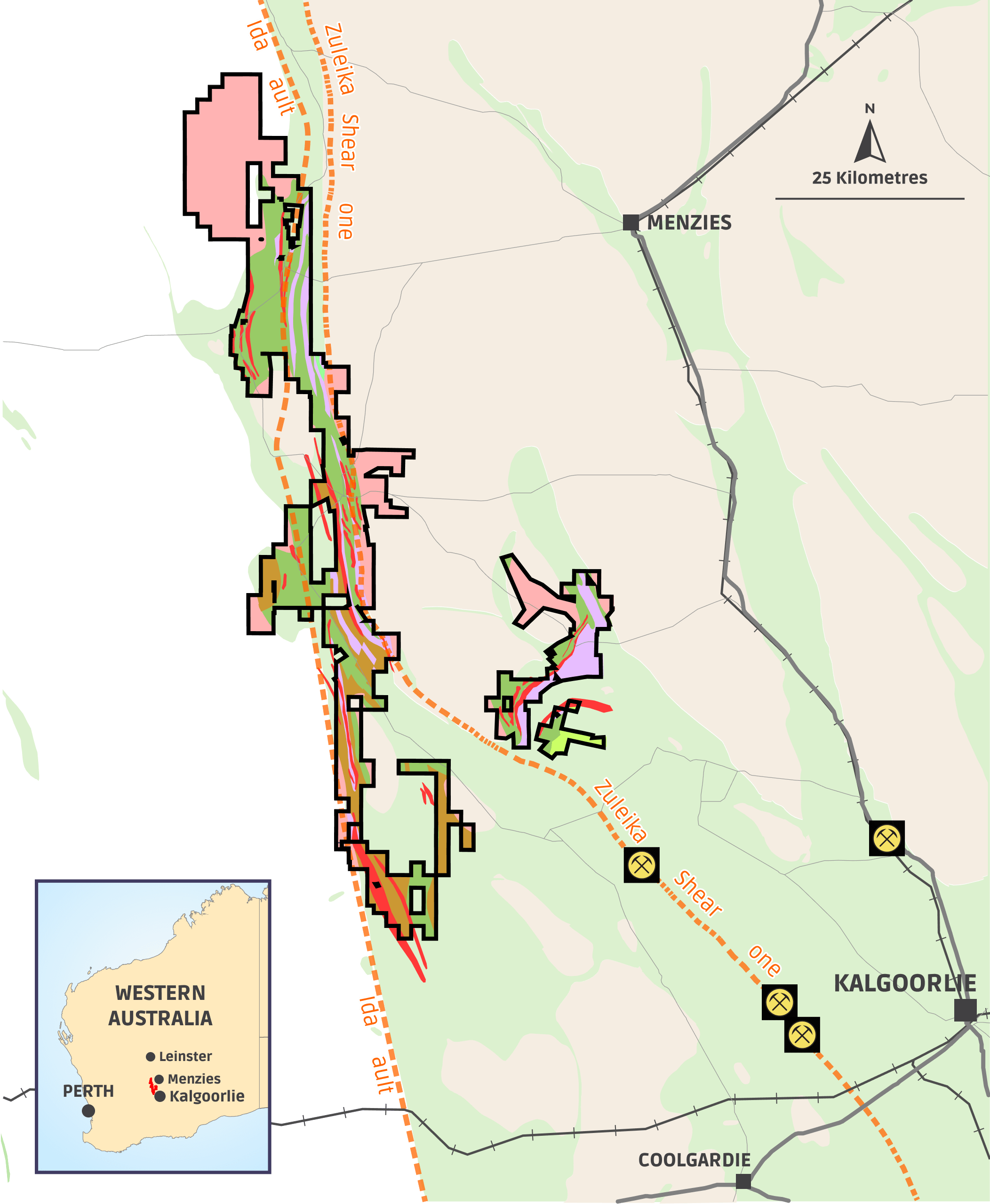

The Davyhurst Project located about 120 km northwest of Kalgoorlie, right in the heart of WA’s Eastern Goldfields—one of Australia’s top gold-producing regions.

Ora Banda Mining (OBM) holds 68 granted tenements across 1,140 km², covering around 130 km of highly prospective greenstone belt. With two underground mines in production, OBM is actively drilling to extend mine life at Riverina and Sand King, while fast-tracking key prospects like Little Gem, Waihi, Mulline, and Round Dam.

Project History

Gold was first discovered here in the 1890s, with towns like Callion, Davyhurst, and Mulline springing up around early mining activity. Between 1890 and 1950, small to mid-sized underground mines produced around 600,000 ounces.

Modern exploration commenced in the 1980s, with various companies operating across fragmented tenements. The area was consolidated in 2006, creating a unique opportunity to build a long-term, sustainable mining operation.